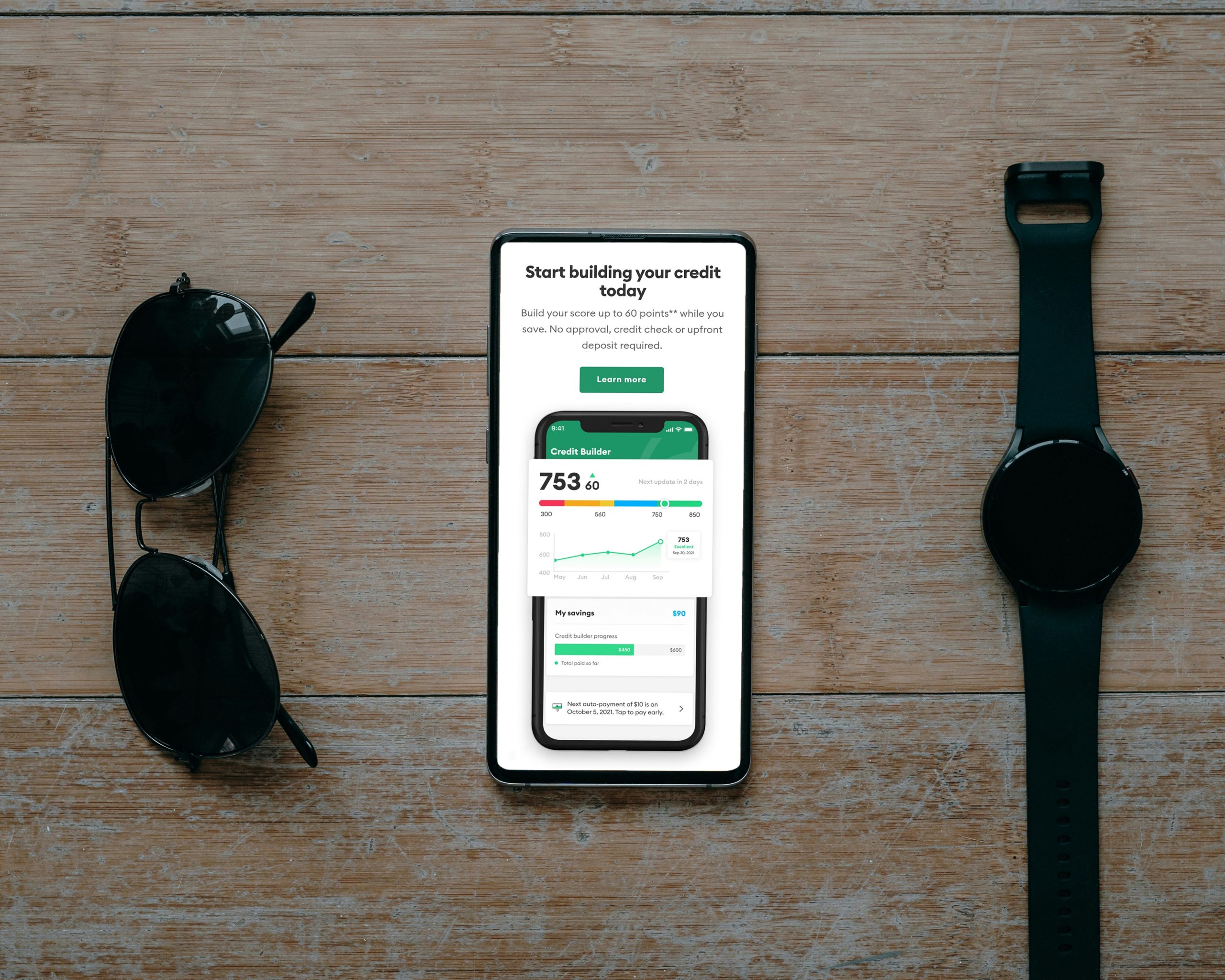

Photo by Frugal Flyer via Uplash.

Picture this: You’ve recently graduated from college and are looking for your first rental home. You’ve spent the last 6 months saving up to cover your first month’s rent, last month’s rent and a security deposit. You haven’t landed a career position yet, but you work a steady job and bring in more than three times the cost of rent at your first-choice property. You’re a shoe-in! Except that you aren’t, actually–because your credit score is indeterminable.

You see, you weren’t the only one to send in an application. Not you or the other applicant have prior rental history–and you both bring in about the same level of income. However, the other applicant has a high credit score of 780. You, on the other hand, have never opened a credit card before! In fact, you might have deliberately avoided doing so after hearing the horror stories of individuals falling into crippling consumer debt, sometimes taking decades to pay off. In turn, you were denied a home based solely on a 3-digit number that you’ve just learned will play a key role in determining what opportunities and privileges you’ll be granted for the rest of your life.

Disclaimer:

Before diving into the topic of credit, I must clarify that no section of this article should be considered financial advice. Rather, this article will instead outline my own experience with credit, highlighting my personal takeaways and observations–both of which are highly subjective. Students should consult with qualified professionals before making important financial decisions and approach the subject with a desire to learn and think critically.

Photo by PiggyBank via Uplash.

I. What is a credit score?

Your credit score is a number that, in the eye of lenders, reflects how likely you are to repay a loan or meet scheduled payments. If you’ve never borrowed money, chances are, your credit score is indeterminable–which makes you ineligible for certain types of loans and barres you from favorable interest rates in most cases. If you have taken out student loans, this can make matters even worse if you haven’t paid off a substantial amount of what you’ve borrowed. To increase your credit score, you’ll need to open a line of credit and pay it off consistently. However, taking out a loan you don’t need for the sole purpose of increasing your credit score enters dangerous and wastefully expensive territory. If you’re looking for a simple way to ensure you’ve got the score you need to get a headstart in life and establish healthy financial habits, you just might want to consider opening your first credit card instead.

Your credit score, specifically your FICO Score, is reported by three main credit bureaus called Equifax, Experian and TransUnion. If credit history is established and determinable, scores range from a very poor score of 300 to a perfect score of 850. Your score as reported by each bureau may vary across the three, but each will generally be similar. Users can check their estimated score for free using popular platforms such as CreditKarma. Once per year, users can request their exact score for free at AnnualCreditReport.com. Typically, anyone with a score higher than 760 will be locked into the best interest rates and opportunities. Your score is calculated by each of the following factors as reported to each bureau:

- Based 35% on your ability to pay your debt on time, also called your “payment history” and should be as close to 100% as possible

- Based 30% on the amount of money available to you to borrow that you’re actually using, also called your “utilization” and should be under 10% if possible but no greater than 30%

- Based 15% on how long you’ve had an established track record of paying off loans, also called your “length of credit history” and considers the time since your first line of credit was established and your average age of credit between all accounts

- Based 10% on how often you’re asking to borrow money by applying for new lines of credit, also called “new credit” and is typically at its healthiest when borrowers avoid opening new lines of credit more than once every 3-6 months

- Based 10% on how many different types of loans you’ve had, also called your “credit mix” and is strengthened when you pay off different types of loans (such as student loans, auto loans, mortgages, etc.)

Opening a credit card can help increase your credit score in four of these five categories. This begins with your length of credit history–which will not see an immediate benefit from opening a credit card, but will mark a starting point in your credit-building process that will impact your score positively the longer you leave it open. Likewise, your credit mix will see improvement by adding a new type of credit line. Where you will see the highest impact, however, is in that a credit card will provide you with a straightforward and consistent way to improve both your payment history and utilization; the two factors that make up the biggest weight of your credit score at a combined 65%. Each month you pay off your credit card on time and in full, your credit score will increase.

On the flip side, however, a credit card application will impact your new credit metric negatively. That said, this small ding to your credit, usually called a “hard pull” or “hard inquiry,” will fall off your report fast and is a necessary step to building credit –so long as it isn’t done in excess!

II. What should I know before opening a credit card?

Before you dive into your first credit card application, there are a few things you should know. While credit cards can help prove responsibility to potential lenders and can even come with valuable rewards and securities for users, credit cards also have the power to ruin lives if misused.

Say, for example, you charge $300 to a credit card during a given month. You fully intend to pay it off on time and in full, but perhaps lose your job or run into an emergency expense a week later. Because you didn’t have any money put away in a savings account, you are now unable to pay off the card and will be charged interest. Not only that, but even your interest will be charged interest! You try to catch up in the following months but the balance is growing faster than you can pay it off. In time, you could end up paying off a simple grocery run for years!

After opening a credit card, most people sincerely believe that they will not fall into the same traps as others. Yet, a whopping 49% of all credit card users carry a balance each month instead of paying off the card and the average American household carries just under $9,000 in credit card debt. In fact, when polling individuals on what they believe will delay their retirement, 30% of participants cited credit card debt. This answer was the highest-reported response amongst participants and was closely followed by medical debt at 29%. This is all to say that, while everyone opens a credit card with the best of intentions, short-term rewards can quickly switch to decades worth of punishment.

To ensure your credit card works for you and not against you, here are some terms you should understand before considering opening a credit card account:

- Billing Statement: This is a summary of your credit card activity during the billing cycle.

- Billing Cycle: This is the period between each billing statement, typically lasting about a month.

- Opening Date: This is the first day that the bank will track your expenses for a given billing cycle. Any purchases made after the opening date will be included in that billing cycle and owed after the closing date on a specified due date.

- Closing Date: This is the last day of the billing cycle, which marks when the bank will send a snapshot to the three major credit bureaus to report your credit utilization. For this reason, it can be a strategic choice to pay off your cards before the closing date, even though the money isn’t technically due just yet. That way, a low utilization is reported to all three bureaus, which reflects positively in your credit score.

- Due Date: This is the exact date by which you need to repay the bank for what you charged to your card in the previous billing cycle. Failing to pay on time can result in penalties such as late fees and can drop your credit score by as much as 100 points!

- Statement Balance: This is the entire amount of money you owe the bank on each due date. If you pay off the statement balance each month, you will never pay interest. You will only owe what you spent, which is why you should only spend what you can afford in cash and is accounted for in your budget.

- Minimum Payment: Instead of paying the entire statement balance, you will also have the choice to pay off the minimum payment at a fraction of the cost of what you actually owe. If you choose to pay only the minimum payment, all other expenses charged to the card will accrue interest at the given APR. Choosing to only pay the minimum payment is how many people find themselves buried in consumer debt and owe sums of money to the bank that increase at a rate faster than the borrower can pay off.

- APR: This is the rate of interest the bank charges you every year for unpaid balances, which on average, is around 23%. However, this “yearly” amount will compound daily starting the moment a balance goes unpaid. This is why it is so important to ensure you pay off your balance on time and in full to avoid accruing any interest at all!

- Principle Balance: This refers to the original amount of money you borrowed from a lender.

- Compound Interest: This describes interest that is charged not only on the principle balance, but also on the interest that has been added to the principle balance.

- Annual Fee: Some premium credit cards, especially travel cards, come with an annual fee. This means you have to pay the bank money each year to keep the card open. If you are simply trying to build your credit, this might be an unnecessary expense. If you do decide to open a card with an annual fee, it is often suggested to hold off on doing so until you already have a few credit cards. This will not only give you time to learn how credit cards work before putting your money on the line, but will also ensure that your oldest credit card can stay open indefinitely and increase your credit age each year without costing you money.

Understanding these terms plays a crucial role in understanding what is expected of you when opening a new line of credit. Once your account is open, it will be your responsibility to ensure the lender is repaid.

III. What are some of the pros of using a rewards credit card?

For those who use credit cards responsibly, credit cards can benefit users in more ways than simply increasing your credit score. Rewards credit cards include extra benefits such as cash-back rewards, travel credits, sign-bonuses, securities and special perks granted to cardholders. These types of credit cards are typically split into two categories: cash-back and travel. Before breaking down how users can benefit from each, please bear in mind that credit card rewards, sign-up bonuses and other perks can change frequently, as can their overall value. The rewards outlined in this article are simply examples that reflect existing offers at the time of writing.

Cash-back cards often offer the simplest structure in terms of rewards, offering an effective discount on each purchase made on the card. This includes cards like the Citi Custom Cash Card, which will give you 5% cash-back on what you charge in your highest spend category, such as groceries, gas, or entertainment. Travel credit cards, on the other hand, will reward you with travel credits. This includes credit cards like the Capital One Venture X, which earns 2 points for every dollar spent. Points can be used to redeem travel credits and can be transferred out to travel partners for free flights, hotel stays, rental cars and other travel vouchers.

Many rewards credit cards come with lucrative signup bonuses for opening an account. For example, the Chase Freedom Unlimited cash-back rewards credit card will give you $200 back of the first $500 you spend on the card during the first 3 months. Sign-up bonuses on travel credit cards are not typically geared towards college students who are in the beginning stages of their credit-building process, but do often come with high-value offers for cardholders who travel often and can meet high spend requirements without exceeding their normal spending habits. This includes cards like the Chase Sapphire Preferred and Chase Sapphire Reserve, which offer new cardholders 60,000 points (valued at approximately $750, varies based on your preferred travel partners) after spending $4k in the first 3 months.

Unlike cash-back focused credit cards, travel credit cards usually come with annual fees, sometimes up to several hundred dollars or more. They are geared towards individuals who travel frequently for work or for leisure and usually in a higher income bracket. For this reason, many popular travel cards will offer perks such as TSA pre-check, global entry, no foreign transaction fees and insurance on travel related purchases. While these kinds of perks are typically unique to travel credit cards, some cash back rewards credit cards offer special perks such as cell phone protection, general purchase protection and extended warranties–all without needing to pay an annual fee like you would with most travel credit cards.

As an additional benefit, many popular credit cards offer a 12-15 month grace period of 0% APR. This allows users to pay only the monthly minimum payment without accruing interest on the statement balance for a set amount of time. For those who are experienced with utilizing credit, 0% APR rates can be helpful when used as an interest-free loan–so long as it does not drastically impact their utilization and the user holds the funds to pay the statement balance before interest accrues.

However, this perk can oftentimes create bad habits and should thus be approached carefully and strategically. Without the fear of interest accruing, some users might grow accustomed to paying off only the minimum payment instead of the full statement balance. Likewise, some cardholders might even feel inclined to charge money to the card they don’t actually have, justifying it with the belief that they’ll have plenty of time to pay it off later. This is a dangerous game to play and does not account for the variables that could impact your ability to pay between now and later. For this reason, it can be wise to use your first credit card as an opportunity to practice responsible usage and ignore the introductory 0% APR benefits.

IV. What are some of the cons of using a rewards credit card?

When striving to get the most out of rewards credit cards in either of the two categories, there are a few things to keep in mind to ensure what you’re getting is actually useful. Firstly, the card you open should match your regular spending and compliment a budget reasonable at your income. It does not save you money to spend more money than you have to meet a sign up bonus requirement, or to receive 3% cash back on all dining purchases when you can’t afford to eat out. Rewards are not a justification to spend outside of your budget and can easily lead to crippling debt!

Even when spending within your regular spending habits, studies show that consumers are twice as likely to spend more when using cards, debit or credit, instead of cash. So, be sure to take a proactive approach to saving money if your true goal is financial freedom. Remember: choosing to purchase only what you can afford is equal to 100% cash back on things you don’t need! Carrying a balance on a credit card will significantly outweigh any benefits of any credit card, every time–so don’t risk it! When your APR is 24-33%, receiving 2% cashback on new purchases while carrying a balance could perhaps be compared to shooting at a fire with a squirt gun.

Second and most pertinent to travel credit cards, points often devalue over time. This means that what you can redeem for 60,000 points today can be far more valuable than what it can get you next year. For this reason, choosing to hoard your points as a savings tactic is a losing game for many. Points can also vary drastically in value depending on how you use them, making redemption feel overly complicated and stressful to many users. On top of that, many redemptions are subject to blackout days and restrictions, meaning that you will often be traveling on the bank’s terms. For these reasons, many credit card holders choose to opt in to cash-back for a more straight-forward approach.

However, planning and keeping track of any kind of rewards can require some amount of planning for casual card-holders, resulting in many people redeeming rewards ineffectively or not at all. In fact, nearly 70% of rewards credit card holders between either category are sitting on unused rewards, defeating the purpose of rewards credit cards altogether. Those carrying a balance on their cards, nearly half of all users on average as reported earlier, are paying a great price for the promise of free perks and rewards.

V. Is a credit card right for me?

Given the risks and rewards associated with opening a credit card, it is a highly personal decision whether you believe one outweighs the other. The truth of the matter is this: You know yourself better than anyone else does. So, consider asking yourself a few questions before opening a credit card account. Such questions might include:

“Do I have enough self-control to only charge to my card what I can afford to spend and is accounted for in my budget?”

“Do I have the discipline to avoid using my credit card to fund impulse purchases or addictive spending patterns?

“Do I have the time to sit down once a week and manage my accounts, ensuring that payments are made on time and in full and that my spending is organized?”

“Are my finances stable enough that an emergency expense would not impact my ability to pay off my card as planned?”

“Will opening a credit card help me in terms of meeting my long-term financial goals, such as owning a home or paying off my student loans?”

If you answered “no” to any of these questions, it’s possible that a credit card might not be right for you. However, if you believe a credit will help you reach your financial goals, consider reading more about where to start towards the end of this article.

VI. Credit cards aren’t for me. Now what?

So, you’re not a credit card person. There’s nothing wrong with that! “But how do I get that rental application approved or the more favorable interest rates if I decide not to use credit?” you might ask. Well, for individuals who decide to opt out of credit cards entirely, there are still some options that prove to be feasible alternatives with the right level of care and planning.

Firstly, if you have any existing debt, it is important to pay this off as soon as possible. An indeterminable credit score will leave you with more options than a poor credit score. Failing to manage existing debt is how you keep that score both active and damaging! Once you are caught up, it will take approximately 2-10 years for your credit score to disappear. If your credit score is already indeterminable, here are a few tips on how you can improve your odds at approval for necessary lines of credit or living arrangements, such as renting or owning a home:

- Sweeten the Pot: Some apartment complexes and realtors are willing to work with renters who do not have a credit score. This often involves saving up 3-6 months rent to pay up front or offering a larger security deposit. Some places might also request that your verifiable income is a certain amount larger than the annual cost of rent, for example four times the cost. This would mean that you’d need to have a verifiable $96,000 annual income to rent a property that costs $2,000 per month ($2,000 x 12 months = $24,000 x 4 = $96,000). Simply call the realtor or apartment complex you are vetting and ask them if they work with individuals who have an indeterminable credit score. If they do, ask what their application process involves!

- Consider Manual Underwriting: If you are looking to purchase a home or another larger asset, some banks will use a process called manual underwriting in place of analyzing your credit score. Manual underwriting involves the lender taking a deep dive into your personal financial situation, such as verifying your income, length of current employment, existing debts, existing savings and investments and other assets you could reasonably liquidate to ensure you will have the ability to pay off the loan. Manual underwriting is uncommon with popular banks and lenders, though this alternative exists through entities like Churchill Mortgage.

- Build Credit Without Credit: For cases in which you’ve already accrued a large amount of debt that you anticipate will take a long time to pay off (e.g. student loans), you might instead decide that you do want to improve your credit score–but without borrowing money. This is possible! Consider enrolling into services like Experian Boost, which will report on-time payments for rent, utilities and subscriptions to credit bureaus as if you were paying them off like debt. However, only consider doing this if you actually pay your bills on time and in full!

These alternatives require a skill for both planning and saving, but can help you secure future opportunities with less risk than utilizing credit. Remember: applying for a credit card with the hope of boosting your credit score and earning rewards will be in vain if you fall victim to common traps and pitfalls that will tank your score and bury you in consumer debt!

VII. Credit cards are for me! Where do I start?

Nice! You’d like to take advantage of credit and the ways it can improve your life. First, let’s review and expand on the principles outlined previously to ensure your credit cards don’t become a burden. These include the following:

- Prioritize setting up an emergency fund large enough to cover 3-6 months of expenses before applying for a credit card. This can help avoid using your credit card as an emergency fund, which is how many people get trapped in debt following medical emergencies, the unexpected loss of a job, or other unfavorable situations that life can spring onto you at any given moment.

- Pay on time and in full! Set credit card payments to “auto-pay” the full amount each due date. Avoid settling for minimum payments, which defeat the benefits a credit card offers.

- Only pay for items you could afford without the credit card and match your regular spending habits. If you wouldn’t buy it with your debit card or with cash, don’t use a credit card! To make matters simple, consider paying off the card after each individual purchase you make if the bank’s mobile app allows for it. Otherwise, consider transferring the money from each purchase from your checking account to a separate savings account, linking the secondary account to autopay your statement balance. This approach to spending ensures you don’t lose track of your spending during the billing cycle, which could lead to an unpleasant surprise come due date!

- Keep a low utilization rate and never max out a card. Think of your credit limit as the amount of lead that is legally allowed in your food. Reaching your limit is not a challenge! Use less than 10% of your total limit amongst all credit cards and other lines of credit for best results.

- Avoid applying for an excessive amount of credit cards early on. Waiting at least 6 months in between credit card applications can help give you time to learn how to properly utilize each card and integrate it into your budget to maintain organization and intentionality. Not only can applying for an excessive amount of credit cards result in disorganization, but each application results in the “hard-pull” we discussed earlier. Some issues are more sensitive to recent inquiries and may deny your application if they believe you are requesting too many lines of credit in a short time frame–a common red flag on the risk-meter!

- Freeze your credit when you aren’t applying for a new card and review statements regularly for fraudulent charges. Credit card fraud is no joke! Freezing your credit with all three bureaus helps ensure no one applies for new lines of credit other than you and reviewing existing accounts regularly can help spot fraudulent charges right away. If you hardly want to pay off your own debt, I doubt you’d like to pay off someone else’s for lack of paying attention!

As a reminder, these tips are based on my own personal experience and observations and do not constitute financial advice. If you decide a credit card is for you, consider consulting with a professional to outline a plan that works for you!

Now, where to start? It can surely feel overwhelming to try to figure out how to apply for a credit card and which cards are worth applying for. Not only are some cards better than others, but your options will be quite limited with no prior credit history. For this reason, you’ll likely want to consider some beginner credit cards early on, as your approval odds will be higher when the bank assesses the level of risk associated with lending you money. For those in your position, there are two types of popular credit card options: student cards and secured credit cards.

Student credit cards often come with some rewards, a small sign up bonus and incentives for good grades. They are generally more lenient towards lower credit scores and existing student loan debt, two considerations that could hurt your chances with other types of credit lines. However, these cards might require some credit history to be approved for given their rewards offerings and benefits. A few popular options include the following:

- Discover It Student Card: Rewards include 5% cash back in revolving categories. Also offered, in place of a traditional signup bonus, is an additional 5% match by Discover when you pay off your balance each month.

- Capital One SaverOne Rewards for Students: Rewards include 3% cash back on groceries, dining and entertainment and 1% cash back in all other categories. Capital One offers as a modest sign-up bonus of $50 after spending $100 the first 3 months.

- Bank of America Customized Cash Rewards Credit Card for Students: Rewards include 3% cash back in a category of your choice, 2% cash back at grocery stores, 1% cash back in all other categories. Bank of America offers a $200 sign up bonus after spending $1,000 the first 3 months–a comparatively generous offer in the world of student credit cards.

If you have no prior credit history at all and are unable to be approved for a student credit card, you might next consider starting your credit building journey from the ground floor with a secured credit card. Secured credit cards offer users a way to establish credit at no risk to the bank by loaning you an amount of money equal to a security deposit you pay when opening the account. In other words, you could deposit $200 to get a secured credit card with a $200 credit limit. If you don’t pay it back, the bank keeps your money and loses nothing. If you do pay it off consistently each month with reasonable utilization, the bank will often refund your initial deposit and sometimes even graduate your secured credit card to a standard credit card with rewards. Some options for secured credit cards include the Discover It Secured Card, U.S. Bank Secured Visa Card, Citi Secured Mastercard, Capital One Quicksilver Secured and BankAmericard Secured Credit Card. These cards are primarily for the purpose of building credit and do not usually offer rewards, signup bonuses, or other perks.

Regardless of what kind of credit card you apply for, there are a number of benefits to applying in-branch rather than online. Firstly, applying in-branch application can often lead to higher signup bonuses that are not offered publicly. These private offers are not advertised by banks online and you will not be informed that you’re missing out if you apply on the website. If you cannot find a local branch near you, consider asking around to see if anyone you know has a referral code for a heightened bonus.

Additionally, it can be helpful to talk to a human being who can provide real time assistance when walking through this process for the first time. This might also provide you with a good impression of the quality of customer service you’ll receive from the bank going forward. There are also some reports of certain lenders offering a higher approval rate for applicants who already have an open checking account in good standing with that bank. This could make your current banking institution an appealing option for your first lender, so long as the credit card you apply for meets your existing requirements.

Closing Thoughts

In this article, I have highlighted what are, in my experience, the pros, cons, benefits and risks of using a credit card. What is the overall takeaway? Well, mine is simple: credit cards have the power to bring you closer to financial freedom or pull you further from it. Personal finance is largely shaped by one’s personal characteristics and their unique set of circumstances. I hope this guide has provided a useful starting point in assessing what role credit will play in your life!

Photo by Tierra Mallorca via Uplash.

Very comprehensive, thank you for including credit card options ! This gives me alot more confidence in opening one in the future. Backed by the knowledge of how and when to utilize it.

Thank you for the kind words! Not all credit cards are equal. When building credit, it can be crucial to ensure you keep an eye out for green flags and red flags to ensure your credit card works for you and not against you. I’m happy to hear that you feel better prepared after reading my article!

Super insightful, and well explained – I definitely feel more comfortable with credit cards now!

I am so glad to hear it! Thank you for reading.

This is so helpful! I feel like credit card misuse is such a common thing for college students.

I truly is! It’s important to shape healthy habits early on to avoid falling into the traps that have barred many Americans from comfortable lives and even from retirement. I am a strong proponent of systematic reform, but I also believe it’s important for us as students to set ourselves on track for success in any way we have at least some control over. Thank you for reading!